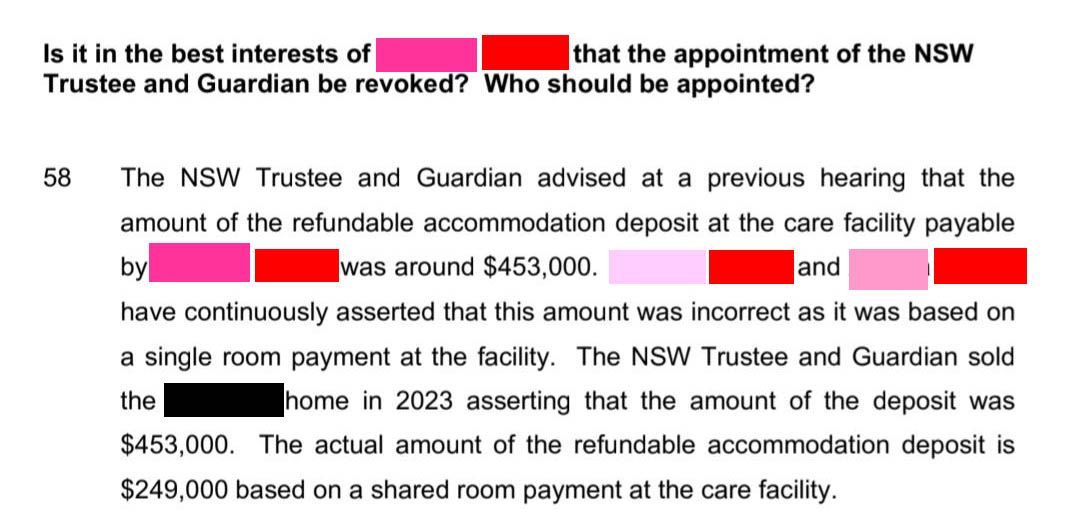

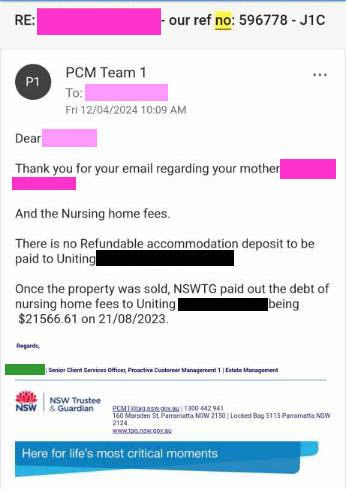

This 2025 Reasons for Decision refers to a 2023 hearing where NSWTG invented a RAD debt for Lee for an amount which could not even have been hypothetically true. Note that it was a shared room anyhow (not single).

Routinely Lies about Client Debt

Faking a Nursing Home RAD

NSWTG (NSW Trustee & Guardian) routinely claim their clients who are in aged care have a RAD (Refundable Accommodation Deposit) owing even when it is not true. They even lie to NCAT about this, who seem to not mind. Such fraud is an offence

under

Section 192E of the Crimes Act 1900 (NSW). This is can be dishonestly putting their client at

"financial disadvantage by deception" in situations where this fictional RAD is used as a rationale to sell the client's property to pay off the imaginary debt. In fact it could also be NSWTG gaining financial advantage for themselves because the money is always secretly invested so that the client never know the true rate of return, only what is passed on to them.

In a phone call with APTAGE in about 2023 a NSWTG agent claimed that if a client owned property, the only option for paying nursing home accommodation fees is to pay a RAD. When he was reminded that the regulations changed in 2014 to allow a daily payment option he acknowledged his error but it seems implausible that he would have made a genuine slip-up.

One client, Dee, was told in writing that a $315k RAD had already been paid, with NSWTG refusing to show evidence (even resisting providing the evidence through a formal summons but NCAT seemed to not mind this contempt).

Another client, Lee, was told she had a $453k RAD. The number didn't even match the amounts theoretically charged by the nursing home. At the time of entry

(30 June 2020) it was $349k for single room and at the time NSWTG reported the fake debt to NCAT

in 2023 it was $440k for single room. However Lee wasn't even in a single room — she shared a room with three others.